Summary Funding Statements 2025

30-second summary

The latest financial health check shows that RWE Group’s funding position improved between 31 March 2024 and 31 March 2025 for both Sections.

As at 31 March 2025 both Sections have more than enough assets needed to pay the estimated cost of member benefits.

Knowing about the financial health of RWE Group is important for all members. The summary below gives you a quick overview of how both Sections (the RWE Section and Innogy Section) are doing financially.

Every three years, the RWE Group undergoes a full Actuarial Valuation. The last of these was as at 31 March 2024. In the years in between, the actuary carries out an annual update.

We are required by law to provide you with a summary of RWE Group’s financial status each year.

How are the finances looking?

RWE Group’s funding position improved between 31 March 2024 and 31 March 2025 for both Sections. This is largely due to interest on surplus.

The Group Trustees, with the help of their professional advisers, regularly check and monitor the funding position of both Sections, as well as the company’s financial strength.

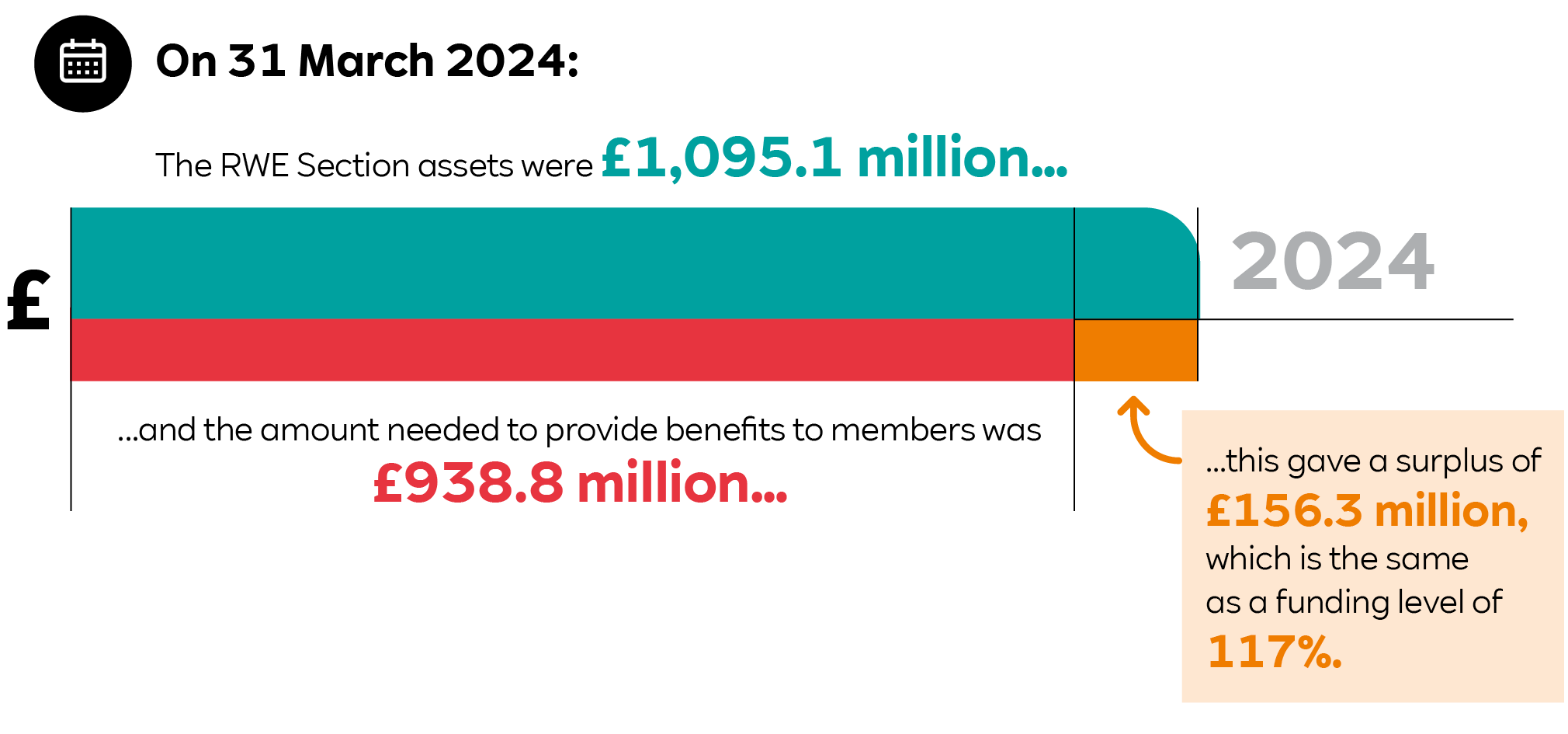

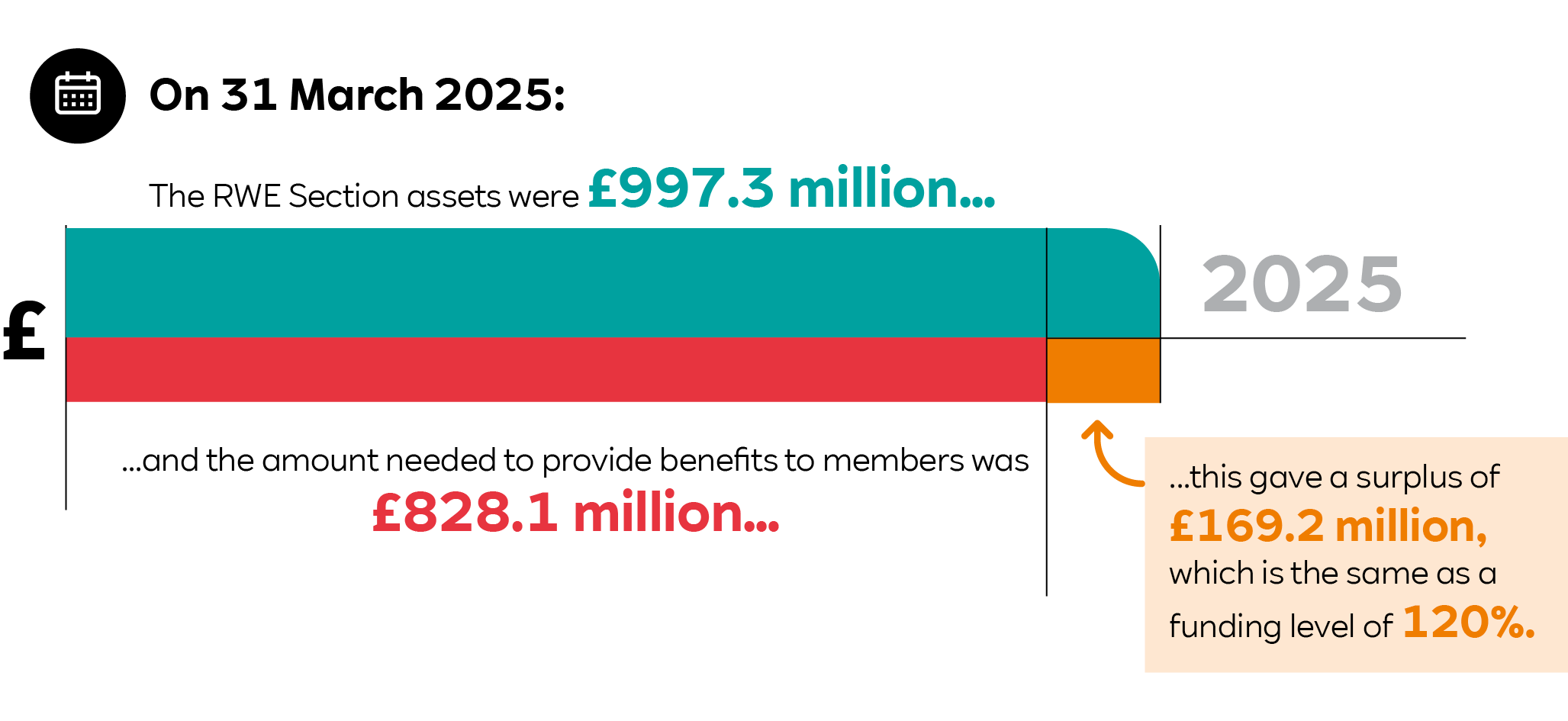

RWE Section

The funding position of the RWE Section improved between 31 March 2024 and 31 March 2025, largely due to interest on the existing surplus. The value of the liabilities reduced as a result of benefit payments and an increase in gilt yields over the year, but this was broadly offset by a reduction in the value of the RWE Group’s assets.

Jargon-buster: GILT yields

Gilt yields are the returns on UK government bonds. In a pension scheme like ours they affect both assets and liabilities:

Liabilities: When gilt yields increase, liabilities decrease. This is because higher returns mean less money is needed to cover the cost of future pension payments (liabilities).

Assets: Many pension schemes invest in gilts. Changes in yields affect the value of these investments (assets).

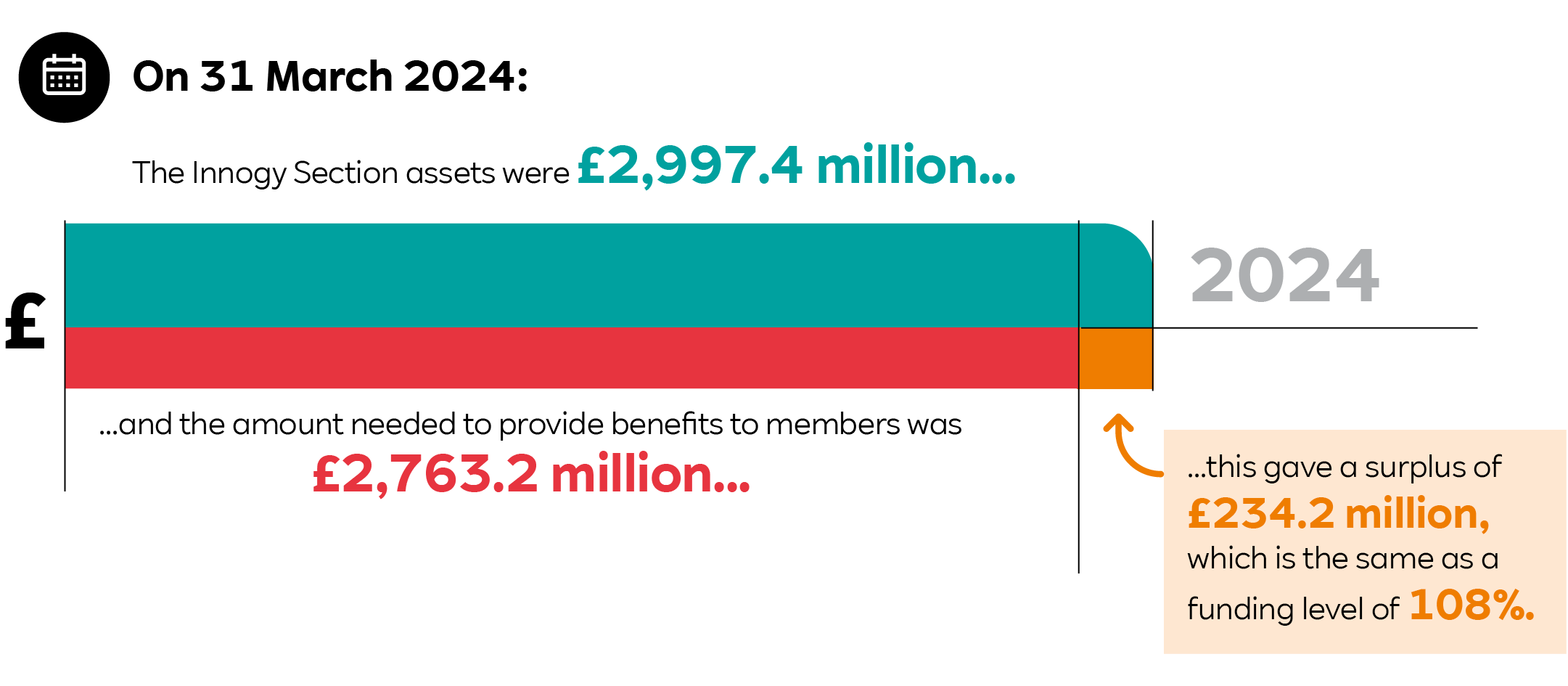

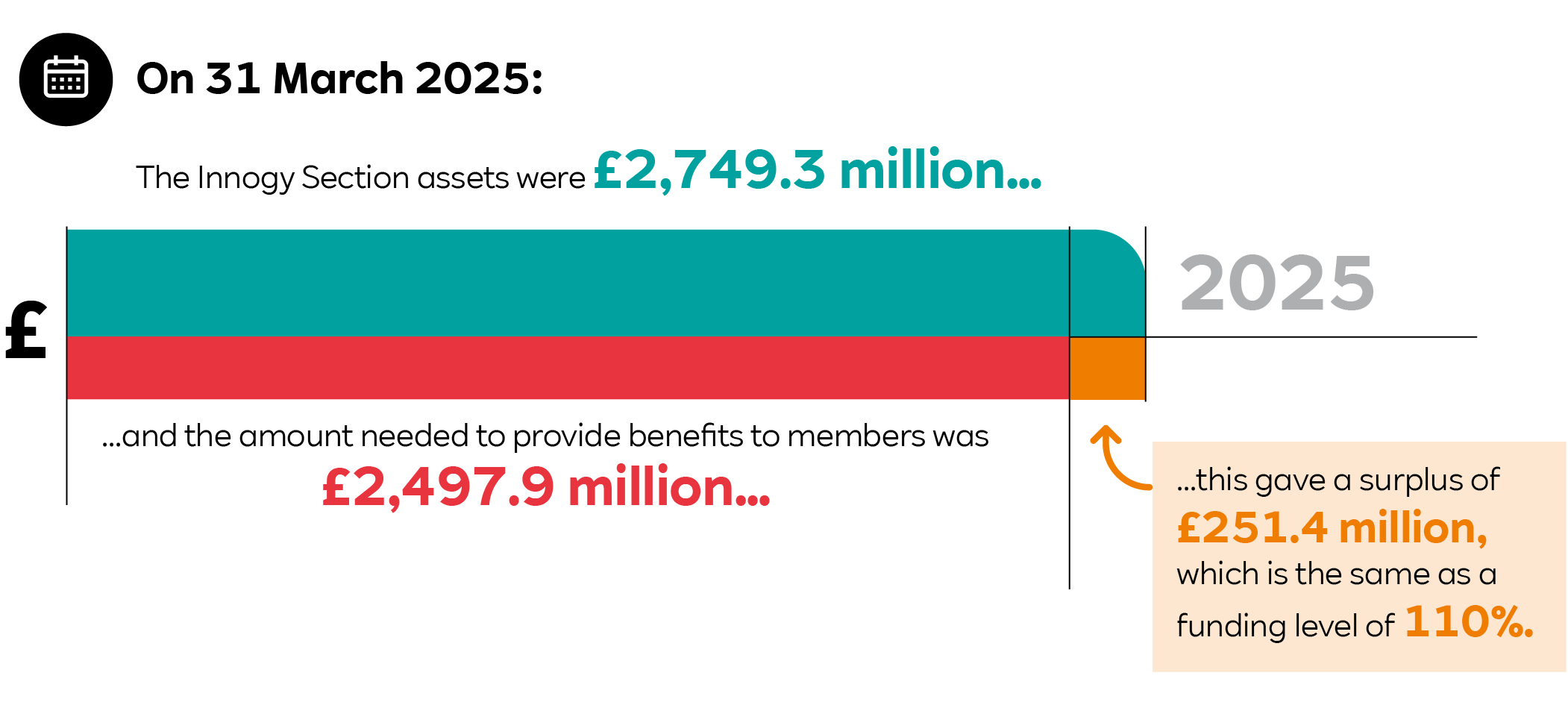

Innogy Section

The funding position of the Innogy Section improved between 31 March 2024 and 31 March 2025, largely due to interest on the existing surplus. The value of the liabilities reduced as a result of benefit payments and an increase in gilt yields over the year, but this was broadly offset by a reduction in the value of the RWE Group’s assets.

The legal statement

In order to comply with statutory regulations, we can confirm that the Pensions Regulator has, to date, had no involvement in the funding of either the RWE Section or the Innogy Section as part of the 31 March 2025 annual update and that there have been no payments out of either the RWE Section or the Innogy Section to the company.

A message of reassurance

Both contributing members and their employer companies make contributions to the RWE Group. The Group Trustees invest in assets that broadly match the RWE Group’s liabilities.

They regularly check the company’s covenant to ensure that the company is able to support the RWE Group.

Costs to wind up

We are sharing this information with you because we are required to do so as part of our report. It does not mean that the company or the Group Trustees are thinking of winding-up the RWE Group.

As part of the valuation the Actuary also works out how much money the RWE Group would need if the RWE Group were to be wound up and the Group Trustees secured members’ benefits by buying an insurance policy. Securing benefits in this way is expensive.

For cases where a company goes out of business and does not have the money to pay the benefits promised, the government has set up the Pension Protection Fund (PPF) which can pay compensation to members. You can find out more about the PPF on its website.

An Actuary is a professional who helps organisations calculate liabilities and risk. They calculate the liabilities to help make sure there are enough assets to cover members’ pension benefits.

Costs to wind up the RWE Section

The Actuary calculated that if the RWE Section had wound up on 31 March 2024 (the date of the last full Actuarial Valuation), it would have had £48.0 million more assets than the estimated cost of ensuring that all members’ benefits (including wind-up expenses) could be paid in full, equal to a funding level of 105%.

If there is not enough money in the RWE Section to buy out all the benefits with an insurance policy, the company would have to make up the shortfall.

Costs to wind up the Innogy Section

The Actuary calculated the additional funding required to ensure that all members’ benefits (including wind-up expenses) could be paid in full if the Innogy Section wound up on 31 March 2024 (the date of the last full Actuarial Valuation). This was £81.2 million, equal to a funding level of 97%.

If there is not enough money in the Innogy Section to buy out all the benefits with an insurance policy, the company would have to make up the shortfall.

Climate Change reporting

In line with statutory requirements, pension schemes like the RWE Group, above £1bn in size, are required to produce climate change disclosure reports.

These illustrate how climate change risks and opportunities are being managed. A copy of the most recent RWE Group TCFD Report 2025 is available on the LIFETRACK log in page under ‘Scheme Information’.

You will also find the ESPS TCFD Report, produced by the Electricity Supply Pensions Scheme, on that page. TCFD stands for Task Force on Climate-related Financial Disclosures.

If you would like a paper copy of the report, please either send an email to GArwe@trusteesolutions.co.uk or contact the Group RWE Administrator by calling 07787 273 476.

LIFETRACK

LIFETRACK